Pause on Applications

You may have noticed that we’ve switched our application process to be invite-only - while we know that may disappoint some of your friends who were thinking about applying, we promise it’s for a good reason. After being live for almost a year and a half (wow!), we felt like we’ve learned quite a bit about how we could improve our application processes, both externally and internally. To make as clean as possible of a transition between the old and the new, we’ve decided to temporarily pause applications. We can’t wait for you to see what we’re working on - stay tuned!

Equifax Breach Response

We know what you’re thinking: another day, another data breach…

Final Announces Apple Pay® and Advanced Card Controls to Enhance Payment Security

Final, the fintech company bringing transparency, control and security to credit cards, announces today Apple Pay availability for its cardholders. Through Apple Pay’s easy and secure payments on the web or in-person, Final is helping digital-age consumers take back control of their credit cards. In addition, Final is introducing advanced controls for its merchant-locked virtual cards, allowing cardholders to set custom monthly or lifetime spend limits for merchants like Netflix, Amazon and Lyft, furthering their level of control over card spend.

Fraudulent transactions made online or via phone increased 40 percent over the last year, making today’s consumer exceptionally more vulnerable to security breaches and hacks. Grey charges plague customers, when they forget about subscriptions or have services raise recurring prices without notice. Final’s proprietary technology reduces the hassles and headaches that come with a compromised account and grey charges. At its core, Final was created to make credit card users’ lives easier and provide a fundamentally better card experience than is offered today – shouldn’t your credit card company aim to do that?

Warning: You May Have an Error in Your Credit Report

I’m the kind of person who’s very hands on with personal finance: I budget and track spending carefully on Mint, review credit card statements every month to avoid grey charges, and periodically monitor my credit score on various free apps. Since I graduated college, I thought I had been doing my due diligence and taking all necessary precautions to both save money and spot fraudulent transactions. However, little did I know that I was missing one crucial component: reviewing my official credit reports.

Are you Financially Literate?

Sometimes, team bonding looks a little different at a FinTech company. Recently, we came across WalletHub’s great WalletLiteracy quiz and thought it might be fun to take it and compare our scores. Here’s what we found:

Data Authority

Data security and privacy are becoming common discussion topics in our country. In the wake of hacking scandals related to the last election, Big Bank data leaks, and numerous other breach events, people are realizing that these concepts affect them every day in real ways. Given all of that, we thought it appropriate to share our stance.

Top 7 Resources for Great Travel Experiences

We love to travel at Final - heck, it’s even a part of our origin story! However, we are still start-up employees on a budget, so we’ve found some great resources online to save money while seeing more of the world.

Cut Back on Grey Charges to Save Money

If you’re looking to save some money quickly, checking your bank statements for grey charges is the way to go. Read on to learn more about how to stop and prevent grey charges!

Request for Credit Cards

We at Final have decided to put out a Request for Credit Cards (RFCC), to help bring new ideas and products to market. One might think our Final branded credit card would be competitive, but besides building a product our customers love, what we’ve really built is modern credit card issuing platform that we’re looking to scale alongside partners. Think AWS for Credit Cards.

Fintech First Impressions

No one ever truly knows what to expect from their first job out of college. Going to school for Hospitality Management, all of my jobs up until now have been hospitality based. But as anyone in the Hospitality industry knows; plans change.

Top 3 Resources for Picking a New Credit Card

The average American has 2-3 credit cards in their wallet (source). We know that soon, one is going to be a Final card - but how do you pick the others? We compiled some great resources on picking a new credit card that we wanted to share with you:

Breach Best Practices

Do you know what to do if a breach happens to you? If not, check out this infographic!

Trust Wells Fargo with your Finances? No Thanks.

Here's 3 ways they have already proven they cannot be trusted.

Stop Unsolicited Mail

It should come as no surprise that here at Final, we prefer to get our communications via email - that includes any information from credit card or insurance companies. Unfortunately, despite our best efforts, we still often check our mailboxes to find them stuffed with junk.

Transaction Processing

The time between handing your card over to a merchant and your transaction being completed is fairly minimal - but a lot goes on behind the scenes! Take a look at this infographic to learn about all of the steps (and institutions!) involved in making your transaction work.

Oakland Proud!

A few of us at Final had the privilege of meeting with Mayor Libby Schaaf earlier this week, and we couldn’t help but share our joy with you.

Rethinking what it is to be a credit card in 2017

At Final we spend a lot of time thinking about what it means to be a new credit card issuer in this day and age.

3 Things to Know Before Working at a FinTech Startup

Thinking about working for a FinTech startup, but not sure what to expect? Here are three things you might not know:

Final launches credit card to compete with American Express, Chase!

OAKLAND, Calif. - June 20, 2017 - Final (https://getfinal.com), the Oakland-based credit card technology company has publicly launched its first product. Final aims to directly challenge the largest card issuers in the country - according to its CEO Aaron Frank, the company is building an “American Express for the digital era.”

Announcing our public launch!

About a year ago, Final announced that our “waitlist-only” beta was live.

This was a momentous occasion for us as a company, and for our earliest adopters. Since then, thousands have signed up, learned how incredible a credit card can be and helped us vastly improve our offering.

Today, we’re proud to announce that we are opening applications to the public and reducing the annual fee on our incredible product - based on cardholder feedback - from $49 to… $0!!!

Why Final is Transitioning to TOTP for 2FA

The security of our customers is a big focus here at Final and that focus drives everything from our password policy to how we manage customer data and how we harden our servers. In addition to picking a good password, one of the best things customers can do to protect accounts from unauthorized access is enable Two Factor Authentication (2FA). While we have always offered SMS-based 2FA as an option, we recently added Time-based One Time Pad (TOTP) 2FA and recommend our customers transition to it, if possible. In this article I will explain what 2FA is and why it’s important, how SMS-based and TOTP-based 2FA work, and why we are recommending everyone transition to TOTP.

Launching a credit card program

A few months ago we wrote at a macro level about the number of decisions needed to launch a credit card program and the steps required to release a single feature.

Is Fintech the hardest _____-tech?

Starting a business is easier than ever. Template incorporation and investment docs, business planning advice, website builders, cloud storage, and other resources have become more widely available and cheaper in recent years (e.g.: Stripe Atlas).

Card Transaction Process

I sat down recently with a renowned journalist who wanted to learn more about credit card transaction processing. We discussed the steps involved in every card payment, the parties who facilitate transactions and a 30,000-foot view of the economics involved.

What Is Your FICO® Score?

Every day, consumers are bombarded with ads touting the importance of knowing their FICO score. Many of these include links to websites where they can view their “official” FICO score.

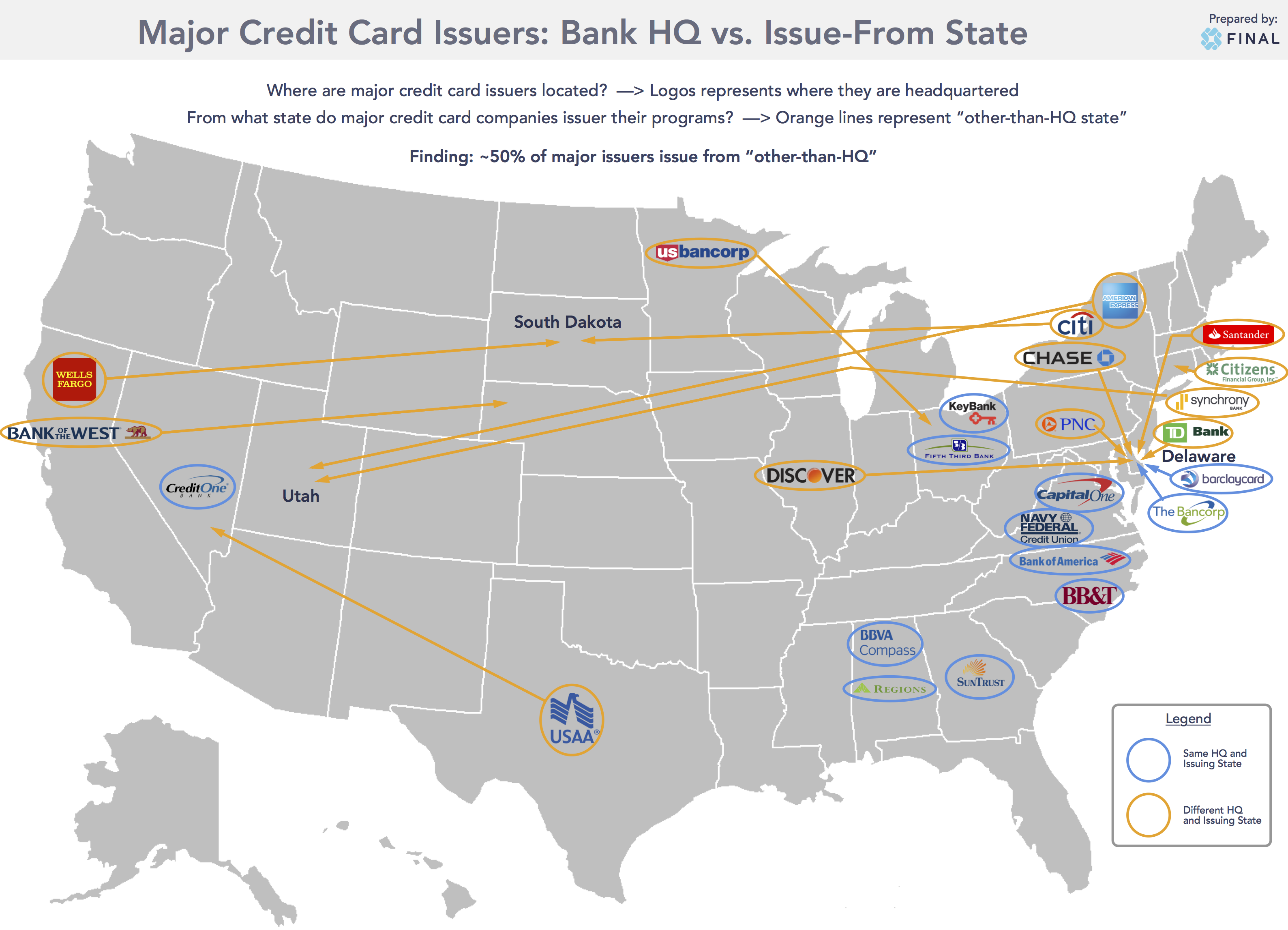

2017 Payment Card Landscape

The card payments ecosystem is massive and shows no signs of slowing down as local and global markets become ever more connected.

So you want to start a credit card program...

Feature Development at Final

Every company, no matter the size, has a unique process for feature design and development - they could follow a traditional waterfall or scrum methodology, or they could create their own process to suit their needs. Social apps and other consumer startups are often able to push new code to production at the end of a 2-week sprint cycle or even daily, but as a company in a heavily-regulated financial space, we’ve had to add some steps to our process that make sure we’re compliant and scalable.

Compliance in Credit Cards!

For more than 50 years, the credit card industry in the United States has consistently done what consumers expect it to - and in many cases, this has been disappointing. When we started Final, we realized we wanted to do things differently. Not everything, but lots of things - motivated by our desire to do better by consumers.

What's coming in 2017!

We’ve been hard at work laying out our 2017 roadmap here at Final, and I wanted to take some time to give all of you a sneak preview of some of the things we have planned!

Reflecting on Our First Six Months of Being LIVE!

In case you were wondering, building a credit card company is a difficult endeavor - it’s probably the most complicated mass market product in one of the most heavily regulated industries - but it has been a rewarding journey. We wouldn’t have it any other way.

Reducing competition by building awesome stuff

We’re live, thanks to you awesome people

Baking in Full-Stack Support to Build [Value] From Scratch

Dear Final, Inc.

Why Final Passwords Are At Least 12 Characters

Why Final is Needed: A Short Anecdote

I’m Helping Start a Credit Card Company, but I’ve Never Owned a Credit Card

Final Secures One Million in Funding and Spot in Y-Combinator

The Genesis of a New Credit Card

Listen Money Matters Podcast Interview

Why Final Is a Design First Credit Card

Why We Launched Final on Product Hunt, Instead of a Traditional Press Blast

Tl;dr — because it’s a community of smart people you can genuinely engage with.