Why Final is Needed: A Short Anecdote

Today I made a rare trip to my closest Wells Fargo branch, which is conveniently located kitty corner to our office here in Mountain View. I think it should made clear that I am a reasonably satisfied Wells customer for my checking and savings needs. This is not a gripe letter.

The reason for the trip (I was recently locked out of my online account) has absolutely nothing to do with the subject of this article. Instead, it’s the conversation that occurred with the personal banker (we’ll call her Laura) once I arrived that is the focus.

So there I am, lukewarm coffee in hand, explaining that I was having trouble accessing my account, which must have been a magic phrase, because I was quickly ushered over to a second personal banker. I sat down and we went through the thorough ID verification process of Laura glancing at my out-of-state driver’s license, and then we quickly went about manually resetting my password. Business done, right? Not quite yet.

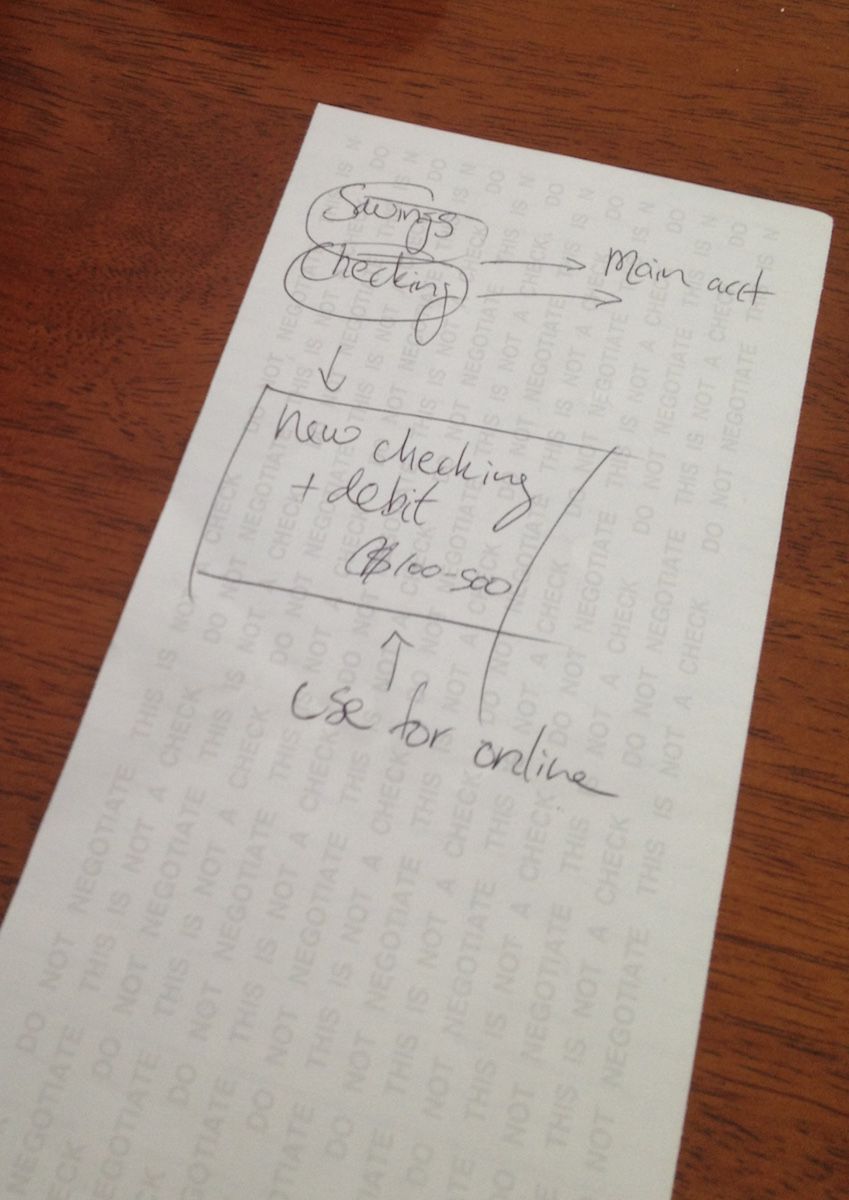

Once that was taken care of, I was given what I’ve been referring to as “the pitch”. Laura took out a spare piece of paper and sketched out my account architecture, I think. She explained that what Wells Fargo is starting to do, is recommend that its checking customers open a second checking account.

In this second account, I could regularly move smaller amounts of funds over, between $100 and $500 at a time, which I could spend using a second debit card. As a security measure, I should use this smaller account for any online purchases, but it would also help prevent anyone from drawing funds from my original checking account, which presumably has more cash in it at any given time.

My response was, “so if I understand correctly, you want me to open a second checking account and manually move funds to that account, along with a second debit card…this sounds a lot like a prepaid card.”

Her response was brief, but powerful. “Yes.”

“Okay, but don’t you think that’s kind of a crummy user experience?”

“Well you see Mr. Apel, there are issues now with Target, Home Depot, and all these stores that are having problems. This is a great option to protect you from those kinds of security things. Of course your funds are insured, but we think it’s a good idea.”

I think it should be noted, that as one of the largest banks in the world, Wells Fargo has 270,000 employees, ~1.7 trillion in assets, services something like 70 million people, and has a reputation as one of the more forward-thinking, user-centric banks amongst the big four. And still, with all those things going for them, their solution to the onslaught of merchant-side security lapses is to open a second checking account and treat it like a prepaid card.

For any nascent business, through the ups and downs of starting a company, there are plenty of downs; from getting the “we’re going to pass, but good luck, and we hope we regret it” emails from VCs, to things never moving as fast as you’d like them to, there’s a lot of times you can start to second-guess your decisions.

Today’s experience is not one of those times.